Usluge:

Klijent:

Cardano (ADA) bounced off the strong support at $1 and broke above the 20-day EMA ($1.13) on Feb. 4. The bears tried to pull the price back below the 20-day EMA on Feb. https://betika-apps.com/ 5 and 6 but the bulls did not relent.

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

Launched in March 2020, Solana is a newer cryptocurrency and it touts its speed at completing transactions and the overall robustness of its “web-scale” platform. The issuance of the currency, called SOL, is capped at 480 million coins.

Bitcoin Cash: This cryptocurrency is a hard fork of Bitcoin that was created to decrease fees associated with Bitcoin transactions by increasing block size. It’s also designed to be more spendable than Bitcoin.

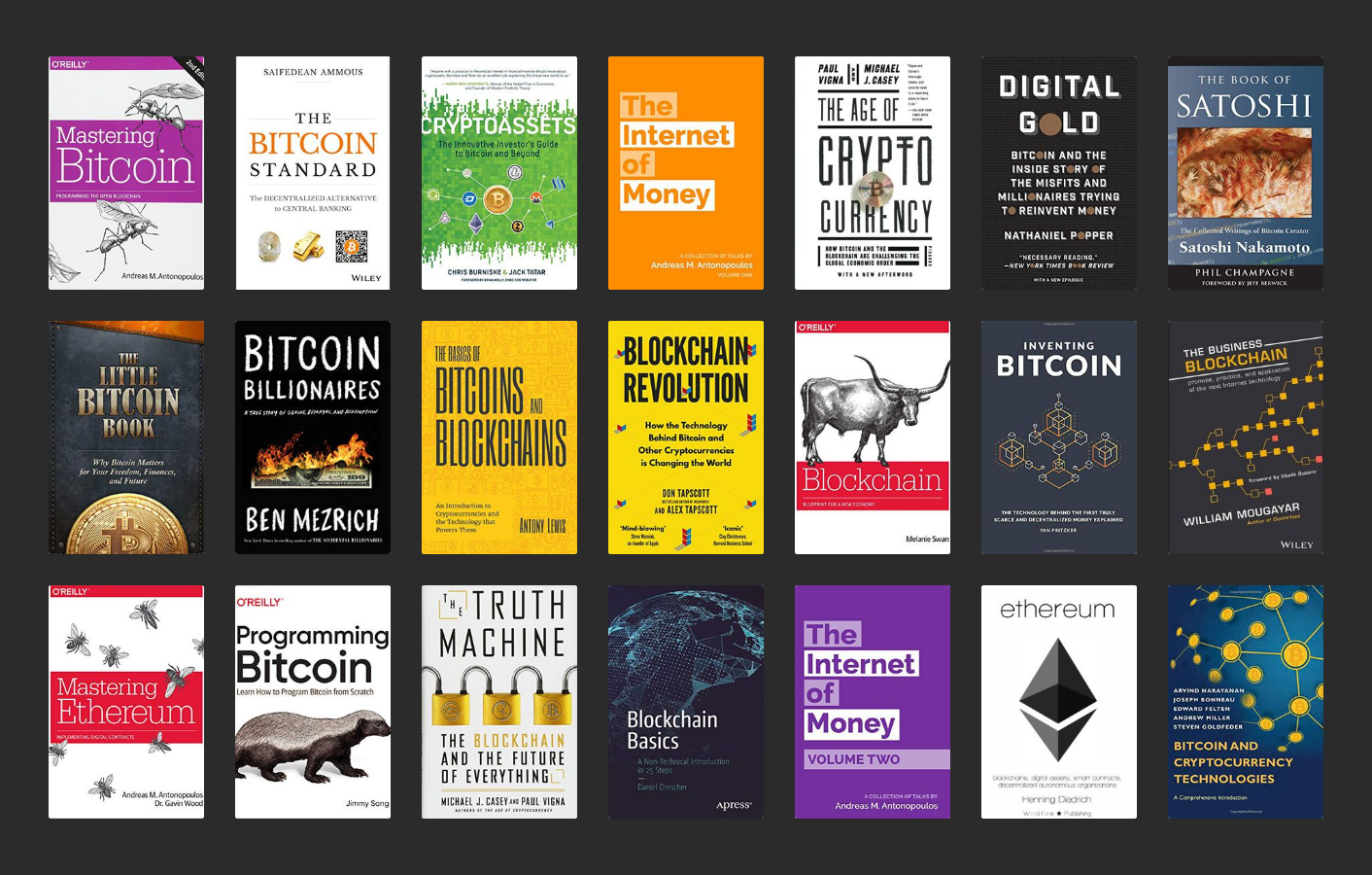

„Crypto Investing: A Long-Term Guide to Managing Risk“ is a comprehensive guide that provides readers with a strategic and practical approach to investing in cryptocurrencies. It covers all aspects of cryptocurrency investing, including the fundamentals of blockchain technology, the history of…

Cryptocurrency’s surge in popularity has sparked widespread interest, but understanding it remains a challenge due to scattered and complex information. ‘A Deep Dive Into The Top 50 Cryptocurrencies: A DYOR Guide’ by Michael McNaught aims to bridge this gap. Catering to both beginners and seasoned…

Blockchain technology is a new general-purpose technology that poses significant challenges to the existing state of law, economy, and society. Blockchain has one feature that makes it even more distinctive than other disruptive technologies: it is, by nature and design, global and transnational. Moreover, blockchain operates based on its own rules and principles that have a law-like quality. What may be called the lex cryptographia of blockchain has been designed based on a rational choice vision of human behavior. Blockchain adopts a framing derived from neoclassical economics, and instantiates it in a new machinery that implements rational choice paradigms using blockchain in a semi-automatic way, across all spheres of life, and without regard to borders. Accordingly, a global law and crypto-economics movement is now emerging owing to the spread of blockchain. This Article suggests that such a rational choice paradigm is an insufficient foundation for the future development of blockchain. It seeks to develop a new understanding of blockchain and its regulation through code according to the emerging “law and political economy” framework. Blockchain is much more than a machine that enables the automation of transactions according to a rational choice framework. Blockchain should instead be understood as a technological infrastructure. Acknowledging the infrastructural dimension of blockchain technology may help identify a new role for the law in its interaction with blockchain, as well as for government in its interaction with the new technology. More precisely, identifying blockchain as an “infrastructural commons” helps us recognize that law and regulation should not be relegated to the role of merely facilitating the operation of the invisible hand of the market by and within blockchain, but should rather acquire more active roles, such as safeguarding access on non-discriminatory terms to users, on a model with net neutrality and other public utility safeguards. The Article closes by proposing a “law and political economy” framework for blockchain that is based on principles of publicness, trust, and interoperability.

Bitcoin: Bitcoin is the original form of cryptocurrency. It was developed by a programmer or a group of programmers going by the name Satoshi Nakamoto. Bitcoin is a decentralized cryptocurrency that relies on the blockchain to distribute its ledger and record proof of work.

This a 20 page e-book made for all persons who have interest on cryptocurrencies. This is a made easy e-book on how to understand the basics of cryptos summarized in the most understandable way it can be so that layman and normal people who have no idea on cryptos can decide if they will invest or…

Shiba Shootout is one of the most exciting new community-focused meme coins of 2024, standing out with its unique Western-themed concept. Featuring Shiba Inus in cowboy attire on horseback, the project builds around the story of Marshal, the sharpest shooter in the crypto world. This creative narrative brings a fresh and engaging twist to the meme coin space, capturing the attention of both crypto enthusiasts and meme lovers alike.

Security tokens are often sold or auctioned in an Initial Coin Offering (ICO) or an Initial Token Offering (ITO) that allows businesses to raise money to fund an idea or business model. The business offers security tokens in exchange for fiat money or other crypto assets. The security token often comes with a stake in the project and additional benefits, such as voting rights, profit sharing or dividends. However, a project may not succeed, and investors should remember they are putting their funds toward supporting an idea of a business model – not a fully realized product or service.

Several areas of risk associated with crypto assets exist, including high volatility, liquidity risk, and heightened potential for fraud. Before buying or selling crypto assets, consider the risks listed below. Anyone considering speculating, buying or trading crypto assets should have a clear understanding of the asset and the risks involved.

In the case of many cryptocurrencies, they’re backed by nothing at all, neither hard assets nor cash flow of an underlying entity. That’s the case for Bitcoin, for example, where investors rely exclusively on someone paying more for the asset than they paid for it. In other words, unlike stock, where a company can grow its profits and drive returns for you that way, many crypto assets must rely on the market becoming more optimistic and bullish for you to profit.

Some CTPs provide a platform for users to buy and sell crypto assets and receive immediate delivery of these assets into their own wallets. This means that the user makes the purchase and the platform has the obligation to deliver the crypto assets directly to the individual, who stores them in their own wallet, over which they retain full control.